Benefits:

Benefits:

CareCredit has many benefits for cardholders including:

Care when you need it

You shouldn’t have to postpone or skip vision care because of expenses not covered by insurance. With CareCredit you can get an eye exam and prescription update when you need to, and manage out-of-pocket costs more easily.

Special financing

CareCredit is different from other credit cards. It’s a healthcare credit card designed to help you pay for procedures and treatments over time and avoid paying interest. No interest will be charged on your balance if paid in full by the end of the promotional period.

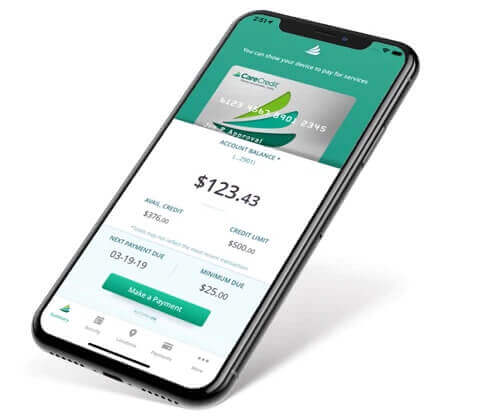

Easy to use

You can apply online or by phone and find out immediately if you’ve been approved. There’s no activation fee and no annual fee**. Once you’re a cardholder, there’s no need to re-apply. you can continue to use your CareCredit card for a wide range of health and wellness needs. You can use CareCredit to pay for health and wellness care at over 200,000 enrolled providers nationwide.

with

with  terms:

terms: